Sometimes there may be a need to transfer funds to friendsor family but you don’t want to use wire transfers or to avoid transfer fees. Thenyou must consider Chase QuickPay as a great solution to your problem. Make yourfree funds transfer to bank accounts and enjoy an easy life at the comfort of amobile app.

Here we will discuss everything which everyone must need toknow about Chase QuickPay before using the service. Moreover, know more abouthow to enroll, send payments, transfer limits and many more questions one canhave in a mind.

What is Chase QuickPay?

Chase QuickPay is an online feature which either you can useat the desktop or via Chase App to sendfunds to other accounts and receive. Because of ‘Free to Use’ characteristic itbecame a highly popular product by Chase® that’s why I also recommend it toyou.

About a year ago Chase revamped its QuickPay and now it ispowered by Zelle to make it more powerful. Zelle Pay enables a user to transfermoney to people even who don’t have Chase bank account. After this ascent, Chase QuickPay is more useful thanever.

What to do if the next person doesn’t have a Chase account?

If your friends or relatives don’t bank with Chase noworries at all. Chase QuickPay still works for such scenarios. In such asituation next person just needs tosign-up for person to person payments at Zellepay.com or can also use theirbank’s person-to-person services.

Following banks offers person-to-person banking feature;

- Ally

- Bank of America

- BB&T

- Capital One

- Citi

- HSBC

- Morgan Stanley

- Navy Federal Credit Union

- Wells Fargo

- U.S. Bank

Some regional banks also offerthis service which includes;

- Amegy Bank

- Bank of Hawaii

- California Bank & Trust

- Central Bank of Oklahoma

If your bank is notin this list HERE IS A LIST. Still unable to find your bank in the list then don’t worry justdownload Zelle app and enjoy the service.

How to enroll in Chase QuickPay?

To enroll yourself in Chase QuickPay you have to registeryourself at Chase QuickPayportal when you click on the blue button saying ‘Enroll in Chase QuickPaywith Zelle’ provider your username and password to sign-in. If you do not havean account then you can sign-up with Chase Quickpay. You will need a bankaccount number, phone number/email and an SSN.

They will verify your identity by sending a verificationcode to either your email or phone number before giving access to QuickPay withZelle.

How to Use Chase QuickPay?

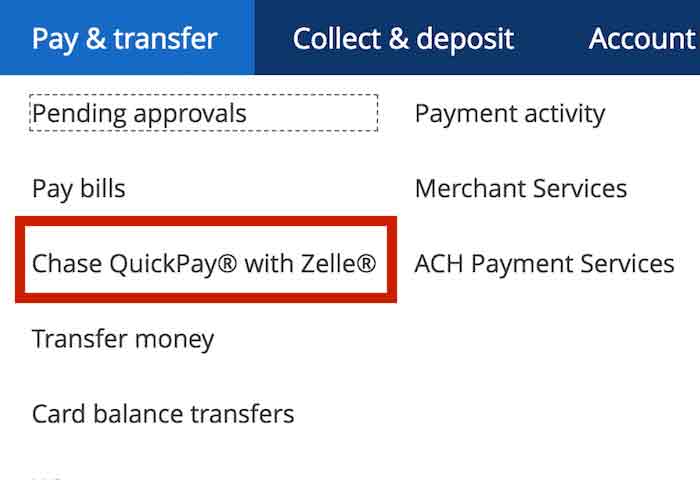

To use Chase QuickPay you must have access to internet either via desktop or with via mobile app. If using Chase QuickPay with a desktop then you can see ‘Pay & Transfer’ option right after you login to Chase.com web portal.

From the menu you will select “Chase QuickPay” and then youwill see multiple options from which you have to select one to continueforward.

- Send money

- Request and split (One can add at maximum 15 recipients)

- View your QuickPay activity

- Manage your QuickPay recipients

- Manage your QuickPay settings

All other options are simple and clear but “Request a Split”is pretty much attractive with a uniquefeature. With it, you can requestpayments from up to 15 participants to pay a bill by simply selecting theiraccounts and giving the amount of moneyto request from all.

How to Send Payments with QuickPay?

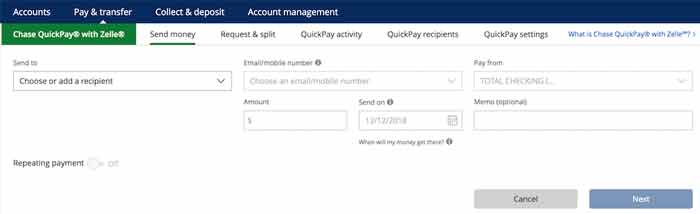

To send payments the process is quite simple and easy also.

- Select recipient

- Provide his/her email address or phone number

- Enter the amount you wish to transfer

- Now provide the date when you want to transfer

- Finally, select your bank account from which youwish to transfer funds.

- The systemwill ask to enter information for a memo but it is optional

- At last, QuickPay Zelle will ask to make thispayment repeating or not

Sending payments with Chase QuickPay Zelle

The recipient willreceive a message or email right after you send the payment while telling theway to receive payment.

Recipients who are new to Chase QuickPay have to sign-upfirst and verify email address to send money. Moreover, if the recipient is not a Chase then you may have to fulfillsome other steps.

- Follow the Chase QuickPay link in the paymentmessage and ‘Sign-up’

- You will need a bank account, SSN, email ID orphone number to verify

- If your payment is under $250 then you will getit instantly

- In other case payments greater than $250 areonly available after you verify your non-Chase account by using a smalltest-deposit.

- Test-deposit normally takes 2 business days toverify.

How to add recipients to a payment

To add recipients to send a payment you have to click on “QuickPay Recipients”.At next click on ‘Add recipient’ now providetheir phone number OR email address.

Note: Youcan add up to 45 recipients to a group. Moreover, none of the participants will be able to banking detailsneither you and nor the recipients.

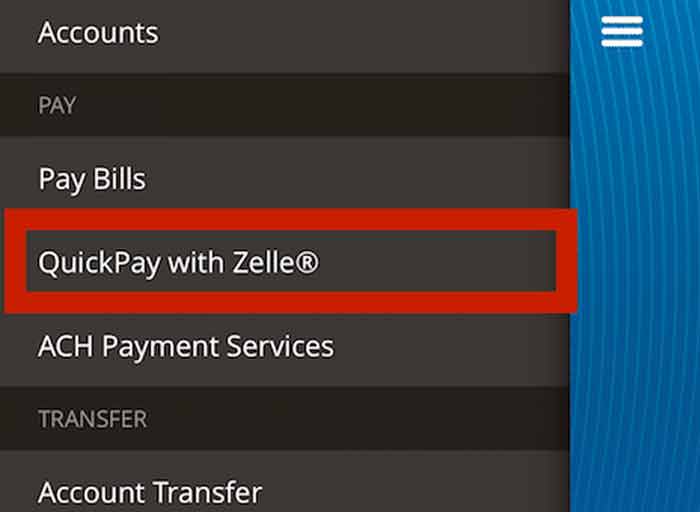

Using QuickPay Zelle on Chase App

You can use QuickPay with Chase app on your mobile. Butmeanwhile be sure that you don’t confuse with Chase Pay with Chase quick pay. Chase Payis a separate mobile wallet app whichallows a user for express checkout. Onthe other side, Chase QuickPay is abuilt-in feature of primary Chase mobile App whichmeans that you can use Zelle QuickPay from that app.

After you log in toChase App then you just need to select the menu from the upper right corner.Here you will see the option ‘QuickPay with Zelle’. Tap on the option and youwill see a new screen with options for sending money, requesting money, splittingmoney and view your activity.

Sending money via app involves same procedures of giving theamount, adding bank account of recipient and date of sending the payment. Ifyou are using the app on iPhone then youmay need to permit the app to use your contacts before getting full performancefrom it.

Any Transfer limits with Chase QuickPay?

Although the service is FREE to use, however, you may have to face transfer limits when using specificaccounts. Commonly every account islimited to $2,000 per transaction and up to a maximumof $2,000 in one day.

Chase checking accounts limit

If you are using Chase checking account or even any Externalaccounts you can send up to $2,000 pertransaction with a maximum of $2,000 per day. Moreover, the limit goes to$8,000 for a period of seven days and up to a maximumof $16,000 for a period of 30 days, from your combined accounts registered withChase QuickPaySM.

Chase Business checking account limit

People can also use Chase business checking account to sendamounts with Zelle. Limit of $5,000 pertransaction with up to $5,000 in a day and up to $20,000 in a period of7-days. Moreover, you can send up to $40,000 in a period of 30 days from all yourcombined accounts with QuickPay.

Private Banking limit

If using QuickPay with Zelle then one can send up to $5,000 per transaction with a maximumlimit of $5,000 in a day. Moreover, you can send up to $16,000 within a 30-day period and for a maximum of $8,000 in aperiod of 7 days. These amounts are aggregate from all your accounts registeredwith J.P. Morgan Chase QuickPay with Zelle.

How long it takes for Chase QuickPayfunds to transfer?

Typically, if you send money to a Chase customer OR a personwho banks with Zelle member banks then he/she will get the money within a fewminutes. If you want to enjoy quickest transfers then make sure that recipientaccepts payment before 10 PM EST.

Virtual instant payments are a great solution for people whenyou don’t trust any third-party involvementwhich is a bit on the shady side.

If the fund’s transferis made from Chase account to a non-Chase account, then it can take about 1-2business days for the recipient to getthe payment after they accept the payment. For quick processing, the recipientmust accept the payment before 8 PM EST.

For how long a payment can wait for acceptance?

Recipients have at max 10 days to accept a payment.Moreover, if the payment is not accepted within that time then as a resulttransaction will be reversed and send will get a refund.

Do I use QuickPay for international payments?

No, you cannot use QuickPay for international transactions. Currently, it is only available for U.S. bankstransfers.

QuickPay Vs. Venmo Vs. PayPal

Beside to Chase QuickPay,one can also use Venmo or PayPal which are 2 other popular options to send orreceive payments from friends. But such services charge a transaction fee of2.9% or 3% while on the other side QuickPay is FREEand the best option for many.

On the other side,Venmo or PayPal allows making paymentsvia your credit card or bank account which can be a good option for many scenarios. Like if the transaction fee islower as compared to your bank then it is a great option to use such services.

Moreover, with QuickPay one can also make a credit cardpayment when you are paying an invoice to a business managing Chase QuickPayand who only accepts credit cards via QuickPay.

How to Cancel QuickPay payments?

The sender can only cancel a payment only if the recipienthasn’t enrolled with Zelle. On the other side if the recipient has enrolledwith Zelle then it means that the transactionis completed and to get the funds back there is only one way. That is to ask therecipient to revert back the funds.

If you have any morequestions regarding QuickPay which are not available here Click here.

Wrapping Up

Finally, in our opinion,Chase QuickPay is a great service to move your funds without any cost.Furthermore, it makes it really easy to transfer money to your friends orfamily without any charge. The Split-upFeature is very nice and aesthetic to pay dining (& other activities)bills collectively.

You can also use your Sapphire Preferred card to pay for bills which earn rewards like dining ortravel and then later share the payment with Qucikpay to get dual benefits fromfriends willing to split the bill.

Lastly, no words to tag this product as a best moneytransfer service by J.P. Morgan Chase for the people of USA.